Why is my coverage more/less than market value?

The dwelling insurance limit is for the rebuild cost of your home; so think about the cost of labor and materials. How much someone is willing to pay for your home because of the market value, neighborhood, schools, land are not part of the rebuild cost.

How much does home insurance cost?

As of 2022 the average cost of homeowners insurance in Washington is $1500/year. Your rate will be impacted by the rebuild cost of your home, discounts, credit score, additional coverages purchased, etc.

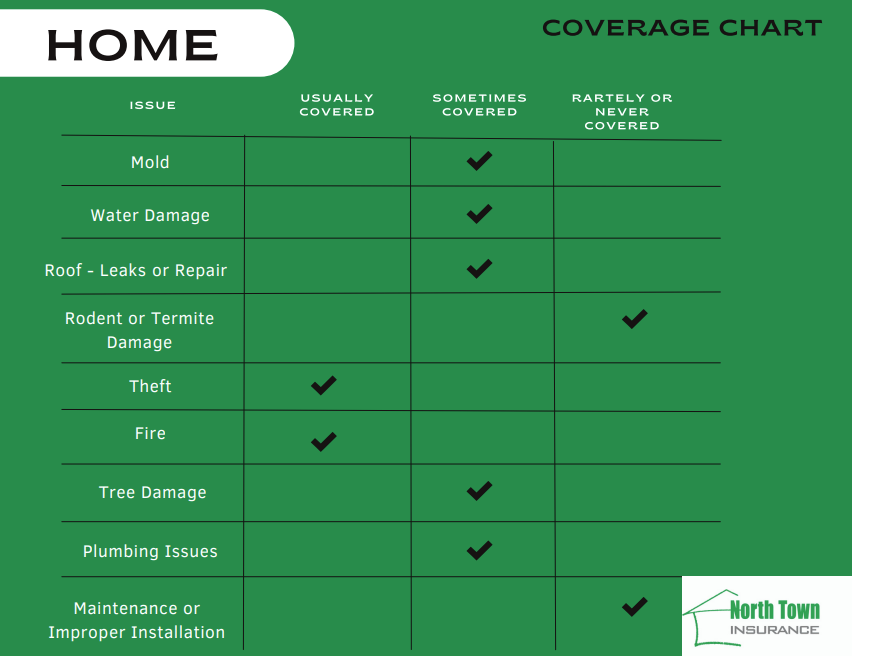

What does home insurance cover?

The standard home insurance covers the repair or replacement of your home, and belongings, in the event of damage. This generally includes damage from fire, smoke, theft, vandalism, lighting, wind, hail. Whenever possible, we encourage a replacement cost policy with comprehensive coverage, rather than an actual cash value policy.

What is a deductible?

The amount of money the policy holder must pay out of pocket, before insurance coverage starts, is a deductible.

What is the difference between actual cash value and replacement cost?

Replacement Cost is the cost of replacing something with a brand-new one. Actual cash value is paying you the depreciated value of your item. With ACV, it is up to you to pay the difference between depreciated value and replacement value, if you want to replace your things. This is a coverage option for your home and belongings.

Does every insurance company do a home inspection?

No, there is no rule that insurance companies must inspect properties. It is at the discretion of the company whether they choose to inspect your home or not. Some factors prompting an inspection may be the age of the property, prior claims or an increase in losses in a specific area.

Will my home insurance cover a storage unit, or property away from my home?

In most cases, your home insurance will extend 10% of your personal property limit (Coverage C) to property away from your primary dwelling; so consider if 10% of your Coverage C is sufficient.

Will home insurance cover my car, boat, motorcycle, ATV?

No, is the short answer. A rule-of-thumb is that motorized vehicles are not covered under your home insurance. They would need their own insurance. *Some home insurance companies can extend SOME coverage to boats, but it’s generally not enough to cover the value.

What are things I can do to lower the cost of my home insurance?

Top 5 things you can do to reduce the cost of your home insurance: 1. Bundle your auto with your home insurance. 2. Get a security system. 3. Increase your deductible. 4. Insurance covers the cost to rebuild your home, no need to increase the cost to cover what you paid for the home. 5. Avoid filing small claims.

Will my home insurance company cancel my insurance if a file a claim?

It is not common, but yes, an insurance company can cancel your policy after filing a claim. Reasons they might do this are: If you’ve not been insured with them very long. If it’s a substantial loss. If there have been multiple claims filed.

When should I file a home insurance claim?

Does the cost to repair the damage greatly exceed your deductible? Is there substantial damage? Is this your first claim? Have you consulted with your agent?

When should I avoid filing a home insurance claim?

Is the cost to repair the damage close to your deductible? Have you filed a claim within the last 3 years? Did the damage result from wear and tear, workmanship or improper maintenance? If you don’t know where the damage came from, have you consulted a professional (roofer, restoration company, contractor)?

What is a CLUE Report?

Comprehensive Loss Underwriting Exchange (CLUE) contains up to seven years of claims history, and helps insurance companies evaluate you as a potential insured.

Does my liability coverage extend to vacant land I own or rent? Why would I need insurance for vacant land?

Many home insurance companies will allow your liability limits to extend to vacant land. This is land with no structures. And liability is the reason insurance is important. Whether you allow visitors on your property (or not), they can get injured and take action against you. Liability coverage will help defend you.

What is an escrow account?

Your mortgage company is helpful by handling the payment of your property insurance and property taxes. To do this, they set up an account with the estimated annual amount of taxes and insurance. They pay your taxes and insurance annually, and then bill you monthly as part of your mortgage payment.

Why would I have an escrow shortage? What can I do about an escrow shortage?

An escrow shortage is the result of not having enough money set aside in your escrow account to cover the actual cost of your insurance and taxes. The most common cause is an increase in rates or inflation for either of these items.

If you anticipate an increase in your taxes or insurance, you can request an Escrow Analysis with your mortgage company and pay the shortage. Otherwise, during your escrow account review, they will give you the option to pay the shortage in full, or have your monthly mortgage payments increased.

Is Earthquake covered on my home insurance?

Earthquake damage is typically excluded from most home insurance policies. This coverage generally needs its own policy, and it’s likely that your home insurance agent can help you with that.

Is Flood covered on my home insurance?

Flood damage is typically excluded from most home insurance policies. This coverage generally needs its own policy, and it’s likely that your home insurance agent can help you with that.

How do I change home insurance companies when my mortgage pays for it?

Here is some information to help you understand the “behind the scenes” of changing home insurance companies. In most cases, this will be a fairly smooth process:

1) What your previous home insurance company (“Company A”) will do: Once you cancel that policy, your previous home insurance will notify your mortgage that your hazard insurance cancelled. Company A will return any unused insurance premium to you directly. *We recommend that you return this money to your mortgage company, designated for your “escrow account”, to avoid a shortage.

2) What your new home insurance company (“Company B”) will do: They will send the new insurance, and an invoice, to your mortgage company, to be paid. In rare cases, your mortgage will not make a second insurance payment in the same year without your permission.

3) What you will do: Return any refund from Company A to your escrow account. If you receive a notice about your home insurance (from either your lender, or the insurance company), loop in your agent and they can help with us. *We prefer a text or email of the letter, to gather all the info needed.

4) What your agent will do: We will notify your mortgage company, immediately, that you have replaced your insurance. We will follow up on any notifications you get from your mortgage.

Upcoming FAQs:

How much will a home claim impact my insurance?

Does home insurance cover water damage from leaks?

What do I do if my neighbors tree damages my home or property?

Is my jewelry covered on my home insurance?

If you have any other questions that we can answer, or clarify, please share with us! You can reach Lisa via email: info@northtowninsurance.com

Disclaimer: This is a general overview, with the intention of bringing awareness to coverages, options, policy information. However, coverage varies between carriers and states. Please check your policy for specifics.