Would you like to know how to save money on your auto insurance? Of course you would! Who wouldn’t? In this article we’ll run through several things you can possibly do to reduce the cost of your car insurance.

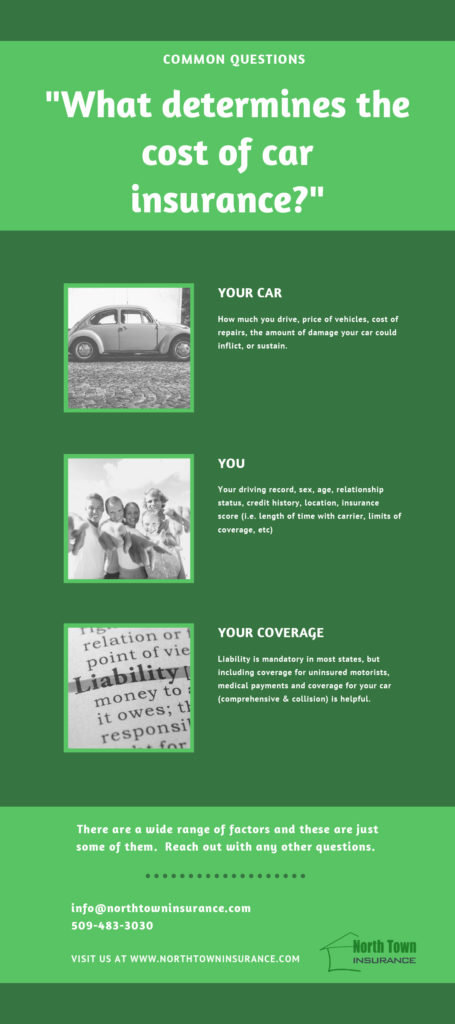

When it comes to insurance for your automobiles, you have some control. There are a few factors to keep in mind that affect the cost of your car insurance. They are:

- Your car

- YOU

- Your coverage

- Increasing your deductible

- Bundling your coverage

Let’s break these down so you can make the right choice for you when it comes to saving money on your auto insurance.

Your Car

Auto insurance premiums are partially based on the car itself. Is it new or used? What would it cost to repair or replace it in the case of an accident? What is it’s overall safety rating? Is there a high or low likelihood of theft? How much damage could your car inflict or sustain in an accident, i.e. massive pick-up truck vs. tiny commuter car. The amount you drive the auto can also affect the cost of your insurance.

You

Who you are and your past and current behaviors can also affect the cost of your car insurance. How’s your driving record? Are you a male or female? How old are you? What’s your relationship status (Need a reason to get married? Saving on car insurance could help you finally commit! LOL). What’s your credit history? Where do you live? How long have you had a certain insurance policy with your current provider? All these things can affect how much you pay. Crazy, huh?

Your Coverage

The type and amount of auto insurance coverage you have can affect your overall cost. Liability coverage is mandatory in most states, but having extra coverage for things like uninsured motorists, medical payments and comprehensive and collision coverage for the car itself can affect the price.

Increase Your Deductible

Increasing your deductible, or the amount you pay out of pocket before your insurance takes affect, can help reduce your monthly/yearly cost. You may choose to increase it from $250 to $500 or $1000 or more, whatever makes the most sense for you. We can help you crunch some numbers and find the best fit.

Bundle Your Coverage

By choosing to bundle your home and auto insurance or insuring more than one vehicle with the same company, you may be eligible for a discount.

Other Ways to Save

Some other discount opportunities we offer at North Town Insurance are:

- Low mile discounts

- Maintain good credit history

- Review multiple carrier options – which we can do through all of our markets on your behalf.

- Good student (3.0+ GPA)

- If you have accidents or tickets, know when they will be coming off your driving record

- Driver Behavior Program: Most carriers offer a program that will give discounts with good driving. They monitor areas like: overall miles driven, hard braking, fast starting, time of day (1 a.m. to 4 a.m. are frowned upon). Most discounts start between 5-10% and can earn up to 20-30%.

- Examples of Driver Behavior Programs include Safeco’s Right Track and Progressive’s SnapShot.

Does this all sound a bit overwhelming? No worries, just contact us and we can help you figure out how to save money on your auto insurance today.

Here’s a related article you might find interesting: