Resources for your Progressive Insurance Policy?

Below are resources for your Progressive Insurance Policy.

We hope these are helpful in your Progressive insurance journey!

Why use Progressive’s Mobile App?

Here are the benefits of having 24/7 to your insurance details:

Here are the benefits of having 24/7 to your insurance details:

+ Access to your ID Card or coverage details.

+ Make a payment, change your account information or adjust your payment date.

+ Report a claim, follow claims status and upload photos for a faster turnaround time. This includes requesting Roadside Assistance.

+ Text APP to 99354 to get a link on your phone. Or download from the App Store.

What are your billing options?

Below are billing resources for your Progressive Insurance policy! Progressive offers bill by mail, paperless billing or reoccurring payments from your checking account / ACH.

Call-In Options: By calling the billing department at 1-800-776-4737, you have 24/7 options to make payments, change account details and set up or stop EFT.

Call-In Options (RE Home/Renters Insurance): 1-866-274-5677

Online/Mobile App Options: Through your client portal or mobile app, you have 24/7 access to make payments using debit card, credit card (Visa, Mastercard, Discover), checking account, Apple Pay, Google Pay or PayPal. You can access your billing schedule and update account details.

Stop EFT: If you need to stop your EFT payment from drafting out of your account, contact the billing department. However, it needs to be at least 48 business hours before the scheduled payment.

What car insurance discounts are available to you?

Check out these discount opportunities and let us know if you would like to review your policy to find out if you qualify for them:

Multi-Policy: When you have two or more policies with Progressive, you can see an average of 5% savings. Bundling can include property (home or renters), boat, motorcycle, RV.

Multi-Car: When you have more than one vehicle listed on your policy, you can earn discounts.

Continuous Insurance: Progressive honors the amount of time you have remained one of their clients. The amount of the discount will vary depending on the length of time you have been insured with them.

Good Student: If you have a teenage driver in your home, you know how expensive the insurance can get! If your teenager is in school and has a 3.0+ GPA (B average), make sure you share that information with your agent.

Distant Student: If you have a full-time student on your policy (22 years of age or younger), and they live more than 100 miles from your home, share that with your agent and qualify for this discount.

Homeowner: Do you own a home? By being a home owner, you qualify for this discount. Share that information with your agent to get the discount applied!

Snapshot / Safe Driver Program: If you are confident that you are a safe driver, this program offers a personalized rate based on your driving.

Billing: Setting up EFT or paying your policy in full, there are great discounts available to you!

Paperless: To save paper, if you sign up for the paperless program and receive your policy information via email, you qualify for a discount.

*Discounts vary based on State.

What to do if you have a claim?

Most importantly, pull to a safe location, turn off your car, turn on your hazard lights and make sure no one is hurt. If someone is hurt, call 911 and do not attempt to move them.

If there are no injuries, connect with the other party to exchange information. Collect: Name, address, phone number of driver and any witnesses. Driver’s license number, license plate numbers, insurance company details. Take photos of the vehicles and damage, if possible.

You can report the claim to the police, but in Washington State they generally will not send an officer unless property damage exceeds $1,000, there are injuries, or involves a pedestrian, bicyclist or motorcyclist.

For general questions, contact your insurance agent to discuss the situation and review the next best steps.

To report a claim, complete the questionnaire on the mobile app or client portal. Or contact the claims department at 1-800-776-4737.

Contact phone numbers to save:

Service Center 24/7: 1-800-776-4737 Outside of our business hours, Progressive’s service team can assist you with changes, claims, billing and general questions.

Roadside Assistance: 1-800-776-2778 Roadside Assistance will help with towing, lockout, fluid, flat repair and other roadside service. Most policies allow 3 requests (within your policy term) and will tow within a 15-mile radius.

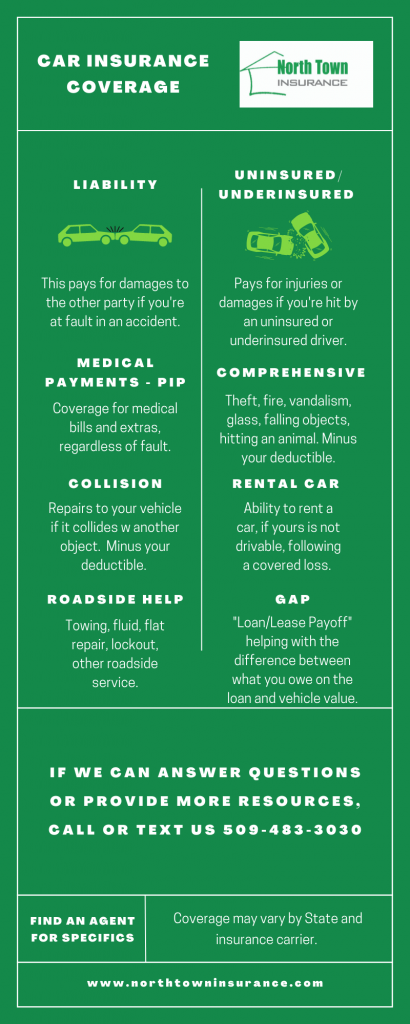

Coverage options available

Snapshot Driving Program

Coming Soon

If you have any other Progressive Insurance questions that we can answer, or clarify, please share with us! You can reach Lisa via email: info@northtowninsurance.com

Disclaimer: This is a general overview, with the intention of bringing awareness to coverages, options, policy information. However, coverage varies between carriers, agents and states. Please check your policy for specifics.