Washington Credit Ban Update

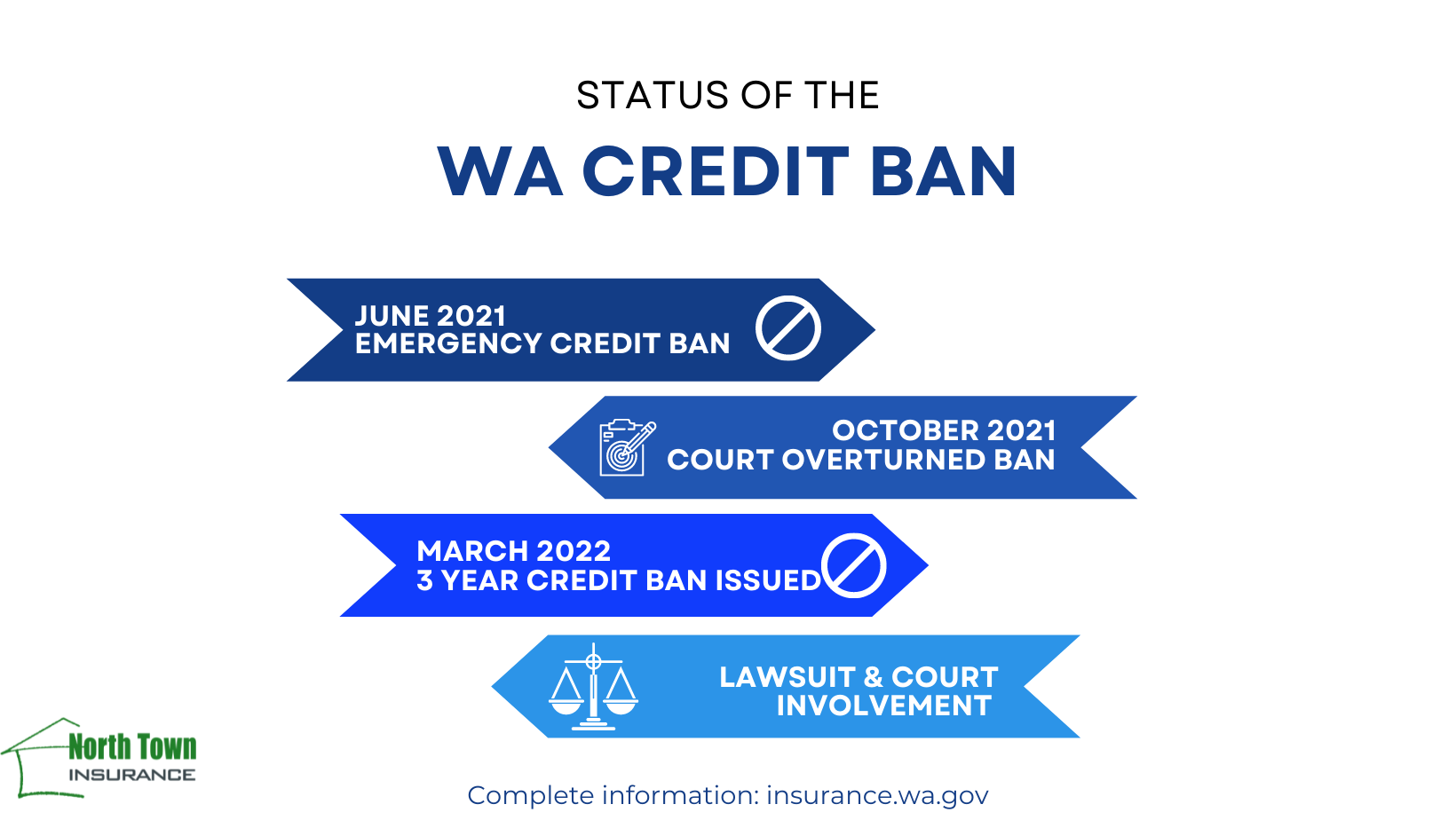

- March 2021: The Washington State Insurance Commissioner made an Emergency Ruling to ban the use of credit. Insurance companies redesigned their systems to remove the credit rating factor.

- June 2021: All personal auto, boat, motorcycle and property insurance policies starting (and renewing) after this date, no longer consider credit in the rating.

- October 2021: The Washington Court system overturned this Emergency Ruling because the Insurance Commissioner did not have “good cause” to file the rule. Insurance companies were able to go back to their original rating system.

- February 2022: Starting March 4, Commissioner Kreidler adopted his rule to ban credit, for three (3) years), and this is following the pandemic-related federal state of emergency.

- What’s next? Insurance companies, and other groups, are challenging this Ban in the judicial system. In the meantime, Commissioner Kreidler’s ruling will stand. Your personal insurance policies will not include credit as a rating factor.

Now What?

We know you have felt this impact. Our own policies have felt it too, but our NTI guarantee is that we review your renewals annually, we proactively compare rates and actively look for opportunities to reduce insurance costs. Check out the FAQ on our website for suggestions on discounts for your car and home insurance.

Now for a little good news…insurance companies are hoping to enhance other discounts to offset the large rate increases. One of those discounts is Longevity. In most cases, frequently moving from carrier to carrier negatively impacts your overall insurance score, so our first focus in finding ways to improve discounts on the current policy.